vov-chr.ru

News

Are Oil Stocks Still A Good Investment

IEA member countries are required to ensure oil stock levels equivalent to no less than 90 days of net imports and to be ready to collectively respond to. Oil and natural gas supply from existing wells naturally declines over time, making sustained investments more important than ever. Growing demand for LNG. It's generally better to buy oil stocks when oil prices are low and expected to rise rather than when they are already high. However, the price of oil affects. Dividends: Oil stocks tend to have high yields for their investors. In flush times, companies across the industry will distribute a good proportion of their. Higher demand and lower inventories should help the top-rated oil stocks outperform. Updated research and articles about old oil stocks and petroleum company histories. Golden Valley Oil & Gas Company Good Luck Oil Company* Goshen Oil & Gas. Conocophillips (COP) Chevron (CVX) and EOG Resources (EOG) are some of the most trending Oil Stocks. Get the most updated comparison by key indicators and. That's mainly because investors tend to buy stocks or funds during market tops when they are expensive and all the news is good, and then sell stocks and funds. Excessive leverage can easily cause oil companies to falter, but debt is a way of life for oil producers, so make sure the companies you buy can manage theirs. IEA member countries are required to ensure oil stock levels equivalent to no less than 90 days of net imports and to be ready to collectively respond to. Oil and natural gas supply from existing wells naturally declines over time, making sustained investments more important than ever. Growing demand for LNG. It's generally better to buy oil stocks when oil prices are low and expected to rise rather than when they are already high. However, the price of oil affects. Dividends: Oil stocks tend to have high yields for their investors. In flush times, companies across the industry will distribute a good proportion of their. Higher demand and lower inventories should help the top-rated oil stocks outperform. Updated research and articles about old oil stocks and petroleum company histories. Golden Valley Oil & Gas Company Good Luck Oil Company* Goshen Oil & Gas. Conocophillips (COP) Chevron (CVX) and EOG Resources (EOG) are some of the most trending Oil Stocks. Get the most updated comparison by key indicators and. That's mainly because investors tend to buy stocks or funds during market tops when they are expensive and all the news is good, and then sell stocks and funds. Excessive leverage can easily cause oil companies to falter, but debt is a way of life for oil producers, so make sure the companies you buy can manage theirs.

With the US being such a large part of the global market it is rarely a wise move to abandon US stocks completely. Even if prices are down you will still. Buy stock in an oil and gas company If you want to invest in oil with little money, your brokerage account is probably the best place to look. With the new. Yes, oil stocks are good investments for long-term investors and possibly deserve a place in a diversified portfolio. Oil shares typically offer. I'm Convinced ARC Resources Is One Of The Best Energy Stocks Money Can Buy. Aug. 25, AM ETARC Resources Ltd. (AETUF) Stock, ARX:CA Stock There are many risks when investing in the oil and gas industry, including dividend cuts, accidental oil spills, and the price volatility of oil and gas. That. If you are buying the stocks of the companies - I think the oil and gas companies are good long term investments with one big potential issue. Investments are spread across most markets, countries and currencies to achieve broad exposure to global growth and value creation, and ensure good risk. The Q2 earnings season showed a picture of strength for U.S. stocks, yet markets stumbled. Carrie King says sentiment was at play and offers 3 reflections. Stocks and bonds recovered some of Thursday's losses ahead of his remarks. Stocks are attempting a recovery early Friday from yesterday's sharp losses, but. The Computershare Investment Plan for Chevron stock allows interested investors to purchase shares of stock and participate in dividend reinvestment. managing. Key Takeaways · It is a commonly held belief that high oil prices directly and negatively impact the U.S. economy and the stock market. · A recent study, however. Peak oil demand is still years off, and AI's rising power needs and the underinvestment in oil and gas hint at a strong future demand for natural gas. That's mainly because investors tend to buy stocks or funds during market tops when they are expensive and all the news is good, and then sell stocks and funds. The price of oil is high, meaning many oil companies are seeing high profits. Analysts expect it may take a while before oil prices fall (although you can never. Before accessing the site, please choose from the following options. If you are an Individual Investor and you have queries in respect of your investment in. The best time to invest in ASX oil stocks Oil is tied at the hip to economic events and political uncertainty, which can make it difficult to time the market. Cofounder @ Carbon Collective. We make (k)'s · years. Historically, oil stocks are highly sensitive to recessions. · years. The. Yes, oil stocks are good investments for long-term investors and possibly deserve a place in a diversified portfolio. Oil shares typically offer. Investments are spread across most markets, countries and currencies to achieve broad exposure to global growth and value creation, and ensure good risk. In April, it has dramatically reduced uncertainty around left tail risks (Fed), max Covid eco damage (May+ reopenings), peak crude inventories (physics), and.

Best Offers For Balance Transfers

The Wells Fargo Reflect lets you skip interest on purchases and balance transfers for 21 months. 5 min read Jul 09, Shot of a young. Balance transfers can be a great strategy to lower your current credit card interest rate. · You can transfer your balance to an existing card or a new one—but. Pay down credit card debt with a balance transfer card and get up to 15+ months in 0% intro APR. Compare balance transfer credit card offers. You may pay a balance transfer fee (which typically ranges from 3%–5% of the transfer amount), though some credit card companies may waive these fees. The. SAVE MONEY THROUGH OUR BALANCE TRANSFER PROMOTIONS. Choose the limited-time offer that works best for you and your finances. All three options include a low. Balance transfers are the best way to save money if you have good or excellent credit history but carry a balance on your card. With a high interest rate. Bank of America® Customized Cash Rewards credit card: Best Balance Transfer Card for Choosing Your Own Rewards; Citi Rewards+® Card: Top Balance Transfer. Active Cash® Card · Intro offer. $ cash rewards bonus when you spend $ in purchases in the first 3 months · Rewards. Unlimited 2% cash rewards on purchases. 10 partner offers · Wells Fargo Reflect Card · Discover it Chrome · Blue Cash Preferred Card from American Express · Citi Rewards+ Card · Citi Double Cash Card · Citi. The Wells Fargo Reflect lets you skip interest on purchases and balance transfers for 21 months. 5 min read Jul 09, Shot of a young. Balance transfers can be a great strategy to lower your current credit card interest rate. · You can transfer your balance to an existing card or a new one—but. Pay down credit card debt with a balance transfer card and get up to 15+ months in 0% intro APR. Compare balance transfer credit card offers. You may pay a balance transfer fee (which typically ranges from 3%–5% of the transfer amount), though some credit card companies may waive these fees. The. SAVE MONEY THROUGH OUR BALANCE TRANSFER PROMOTIONS. Choose the limited-time offer that works best for you and your finances. All three options include a low. Balance transfers are the best way to save money if you have good or excellent credit history but carry a balance on your card. With a high interest rate. Bank of America® Customized Cash Rewards credit card: Best Balance Transfer Card for Choosing Your Own Rewards; Citi Rewards+® Card: Top Balance Transfer. Active Cash® Card · Intro offer. $ cash rewards bonus when you spend $ in purchases in the first 3 months · Rewards. Unlimited 2% cash rewards on purchases. 10 partner offers · Wells Fargo Reflect Card · Discover it Chrome · Blue Cash Preferred Card from American Express · Citi Rewards+ Card · Citi Double Cash Card · Citi.

This is where the credit card issuer pays you to transfer your balance. Finding the best balance transfer deal for you is about more than just an interest rate. Best 0% balance transfer cards ; Lloyds Bank. - Up to 27 months 0%. - % OR % fee. - % rep APR. Check eligibility(i) ; Santander. - 26mths 0%. - 3% fee. Oftentimes, credit unions and other financial institutions will offer low-interest balance transfer specials. If you are currently carrying a high balance on a. A balance transfer credit card moves your outstanding debt from one or more credit cards onto a new card, typically with a lower interest rate. · Many balance. 0% intro APR for 15 months from account opening on purchases and balance transfers. After the intro period, a variable APR of Min. of (+) and. You could pay less interest by transferring balances from other higher-rate credit cards to a Wells Fargo Credit Card. Balance Transfer Intro APR & Period APR: 0% Intro APR on Balance Transfers, Period: 15 month. Which Capital One balance transfer credit card is best for you? ; NEW CARD MEMBER OFFER ; Earn a one-time $ cash bonus once you spend $ on purchases within. Top 10 balance transfer cards (low transaction fees) · Santander - All in one Credit Card - 0% Transfer Fee · Barclaycard - Platinum Balance Tranfer Card - 0%. Balance transfers can definitely work to your financial advantage, and great deals do exist. After all, the less interest you are charged, the more of your. Get 0% Intro APR for 15 months on purchases and balance transfers; then % to % Standard Variable Purchase APR applies. The best Chase balance transfer card is Slate Edge® credit card because it offers an introductory APR of 0% for 18 months on both balance transfers and. Bank of America has credit cards that offer low intro APRs on qualifying balance transfers for those looking to manage one card while paying down credit card. Find balance transfer credit cards from Mastercard. Compare cards from our partners, view offers, and apply online for the credit card that best fits your. Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. · Balance Transfers do not earn cash back. · If you transfer a balance, interest. Discover balance transfer credit card offers today Special Travel Offer. Citi Rewards+® Credit Card. Reviews. Citi. A balance transfer is a type of credit card transaction in which debt is moved from one account to another with lower interest rates. What are good credit card. After that, % variable APR based on your creditworthiness. There is a balance transfer fee of $5 or 3% of each transfer, whichever is greater. If you have. Best Card for Balance Transfer? · discover 3% transfer fee and 0% apr for 18 months · wells Fargo 3% transfer fee and 0% for 15 months · wells. Intro Balance Transfer APR 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the intro APR offer.

Best Way To Get A Loan From The Bank

If you're new to credit, the best place to get a first-time personal loan is your current bank or credit union. If you already have a checking or savings. When you apply for a personal loan, you apply for a lump sum of money that typically gets deposited into your bank account so you can use it as needed. When. How to Get a Large Personal Loan · 1. Check Your Credit Score · 2. Compare Lenders · 3. Gather Documentation · 4. Apply. How to get a loan with no credit or bad credit · Secured loans · Auto loans · Joint loans · Credit card cash advance · Home equity loans · Home equity line of credit. 1. Make bi-weekly payments. Instead of making monthly payments toward your loan, submit half-payments every two weeks. A local loan officer can offer advice, help you navigate the process and maybe even put in a good word for you. Plus, your account with the bank may make you a. Banks offer a variety of ways to borrow money, including mortgage products, personal loans, auto loans, and construction loans. What you'll need · W-2s (for the last 2 years) · Recent pay stubs (covering the most recent 30 days) · Complete bank statements for all financial accounts. If you're broke and need money until payday, asking your bank for a small loan could be a good option. Banks usually offer loans with fair. If you're new to credit, the best place to get a first-time personal loan is your current bank or credit union. If you already have a checking or savings. When you apply for a personal loan, you apply for a lump sum of money that typically gets deposited into your bank account so you can use it as needed. When. How to Get a Large Personal Loan · 1. Check Your Credit Score · 2. Compare Lenders · 3. Gather Documentation · 4. Apply. How to get a loan with no credit or bad credit · Secured loans · Auto loans · Joint loans · Credit card cash advance · Home equity loans · Home equity line of credit. 1. Make bi-weekly payments. Instead of making monthly payments toward your loan, submit half-payments every two weeks. A local loan officer can offer advice, help you navigate the process and maybe even put in a good word for you. Plus, your account with the bank may make you a. Banks offer a variety of ways to borrow money, including mortgage products, personal loans, auto loans, and construction loans. What you'll need · W-2s (for the last 2 years) · Recent pay stubs (covering the most recent 30 days) · Complete bank statements for all financial accounts. If you're broke and need money until payday, asking your bank for a small loan could be a good option. Banks usually offer loans with fair.

A personal loan is one way to consolidate debt or to pay for major expenses. These types of personal loans offer fixed interest rates and fixed monthly payments. house. We can show you how. Learn more. Not sure which loan is right for you? See what fits your lifestyle goals. I'm looking to. Make home improvements. Make. Our personal loan allows you to apply for a lump sum payment. You can use this loan for debt consolidation, home improvements, a trip, or nearly anything else. See how we compare. Filter Products. Citibank Best Egg Lending Club The fast and simple way to get a Personal Loan. portrait of girl smiling. Meet. Wondering how to get a personal loan? Learn about the different types of loans, their requirements and how they can be utilized. Go online and fill out the application with required information. Get a decision within a few days. If approved, you can go to a branch to sign your loan. Borrowers with favorable credit scores — or higher — generally qualify for auto loans with the most attractive terms. · If your credit score is on the lower. how to use small business loans and credit to finance your business needs. Get more information about funding your business with a term loan, SBA loan. right solution and support you each and every step of the way. Happy woman Experience a new kind of mortgage that's built to get you home. We'll be. They do provide small-loans, and have better rate than credit-cards and other "bank" advertising small loan. Is there a way to get a loan for. If you find yourself in sudden financial need, your first call should be to the credit union of bank where you already have an account. Current clients could. Rocket Loans is an online finance company offering low rate personal loans from $ to $ Check out options in minutes without affecting your credit. Credit score: A high credit score shows that you're reliable when it comes to paying down your debt. A good credit score not only can make or break your. A personal loan allows you to borrow money from a lender for almost any purpose, typically with a fixed term, a fixed interest rate, and a regular monthly. You'll have the guidance of a local loan officer, from application to getting your funds. They'll be there to answer your questions, and help you get your funds. To learn how SBA can help you get an export loan, contact your local SBA Get matched to an SBA-approved lender and find the best loans to start and grow your. How can I apply for a personal loan? Current customers can apply in a branch or by phone for a Regions Unsecured Loan or Deposit Secured loan. Additionally. Best personal loans · SoFi: Best overall. · LendingPoint: Best for fair credit. · Upgrade: Best for poor credit. · Prosper: Best peer-to-peer lender. · Axos Bank. Because funds can be deposited directly into any of your bank accounts, you can use a personal loan in a variety of ways. Personal loans are often used for debt.

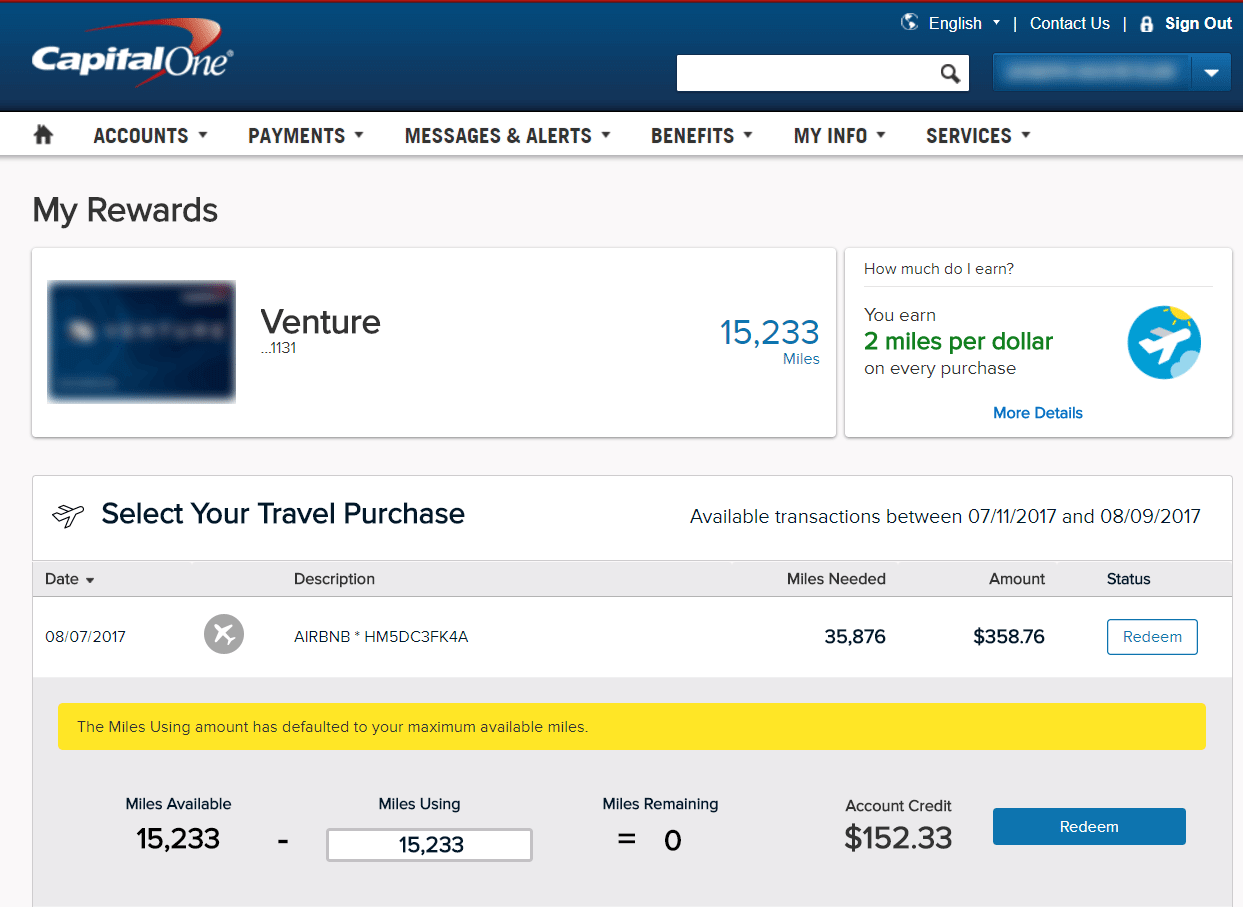

Capital One Bonus Miles Value

With VentureOne, you can earn X miles with a $0 annual fee. Explore VentureOne. VENTURE INDUSTRY AWARDS 2. Additional Value with Ultimate Rewards · Get 25% more value when redeemed for travel. · Plus, ultimate rewards points do not expire as long as the account is open. Has anyone here had success redeeming Capital One Venture points? I've had the card for nearly a year and believe the best option is to just. Cash back isn't the best redemption option for Capital One miles. You typically receive 50 cents per miles, which is half the value of redeeming through. However, the Capital One miles are only worth cents each when redeemed for actual cash back and only cents each if redeemed for purchases through PayPal. Capital One miles are worth 1 cent per mile, but you may get more redemption value when you transfer your miles to one of Capital One's plus travel loyalty. Get 10, bonus miles (equal to $ towards travel) every year, starting on your first anniversary. 2. Annual Travel Credit. Receive a $ Cardholders can see value from the Capital One Venture Rewards Credit Card by spending enough to offset the card's annual fee and using miles for travel. The Capital One Venture Rewards Credit Card has a $95 annual and earns 2 miles per dollar spent on all purchases. Additionally, you can earn 5 miles per dollar. With VentureOne, you can earn X miles with a $0 annual fee. Explore VentureOne. VENTURE INDUSTRY AWARDS 2. Additional Value with Ultimate Rewards · Get 25% more value when redeemed for travel. · Plus, ultimate rewards points do not expire as long as the account is open. Has anyone here had success redeeming Capital One Venture points? I've had the card for nearly a year and believe the best option is to just. Cash back isn't the best redemption option for Capital One miles. You typically receive 50 cents per miles, which is half the value of redeeming through. However, the Capital One miles are only worth cents each when redeemed for actual cash back and only cents each if redeemed for purchases through PayPal. Capital One miles are worth 1 cent per mile, but you may get more redemption value when you transfer your miles to one of Capital One's plus travel loyalty. Get 10, bonus miles (equal to $ towards travel) every year, starting on your first anniversary. 2. Annual Travel Credit. Receive a $ Cardholders can see value from the Capital One Venture Rewards Credit Card by spending enough to offset the card's annual fee and using miles for travel. The Capital One Venture Rewards Credit Card has a $95 annual and earns 2 miles per dollar spent on all purchases. Additionally, you can earn 5 miles per dollar.

When looking at miles and rewards and stuff it's helpful to look up the value of a cc provider's points/miles. They range from about cents. Some loyalty programs offer miles while others offer points. And your Capital One miles will convert at one of three transfer ratios, depending on the rewards. AAdvantage® credit cards ; Special offer: Earn 75, bonus miles. Terms apply. · Citi® / AAdvantage® Platinum Select® World Elite Mastercard® ; Earn 15, bonus. Southwest (Rapid Rewards), , $ ; Delta (SkyMiles), , $ ; JetBlue (TrueBlue), , $ ; Hawaiian Airlines (HawaiianMiles), , $ You can earn miles on every purchase, everywhere and redeem unlimited rewards for all kinds of travel related purchases. See Travel Cards. card sliding into. Enjoy unlimited access to Capital One Lounge locations with Venture X. Plus, earn 75k bonus miles when you spend $4, on purchases in the first 3 months from. The Capital One Venture Rewards Credit Card has a simple earning structure— 5 miles per dollar on hotels, vacation rentals and rental cars booked through. Earn 2 miles per dollar for all spend. Miles are worth 1 cent each when redeemed for travel. Simply use the card to pay for any travel expenses, and then log. The Capital One Venture Card has a phenomenal limited time welcome bonus of 75, Capital One miles plus a $ Capital One Travel credit upon completing. miles equals one dollar's reward. That's exactly average as far as rewards miles go—no better, no worse. For example, if you're earning 2 miles per dollar. Miles Multipliers: Category Spend ; 10X Hotels & rental cars60, Miles ; 5X Flights30, Miles ; 2X All other purchases4, Miles. The worst way to redeem Venture miles is cash back since miles are cashed out at 50% value. Cash back is when you request for the points to be added to your. $1 Capital One rewards cash or miles equals $1 to redeem at vov-chr.ru checkout. Terms and conditions. By enrolling your eligible Capital One credit card in. Rewards Value. Based on our valuations, Venture Miles earned with the Capital One Venture X Rewards Credit Card are worth cents. Here's the breakdown in. Capital One Venture X Rewards Credit Card: Worth It? () ; Venture X Welcome Offer. 75, ; Value of Intro Bonus (Miles) · ; Return on Spend. ; Net. While you won't earn a welcome bonus in the second year, the 10, bonus anniversary miles (worth at least $ toward travel) plus the $ travel credit. Capital One miles are worth around 1 cent per mile when redeemed for travel, so this bonus is worth about $ (or more, with the right travel transfer partner). Plus, earn a 50, miles bonus when you spend $4, in the first 3 months. Once transferred, the expiry and value of transferred rewards are subject to. Further, Chase Ultimate Rewards points transfer to all of its Chase transfer partners. You can redeem your points at up to cents per point in value. The Capital One Venture Rewards Credit Card has a simple earning structure— 5 miles per dollar on hotels, vacation rentals and rental cars booked through.

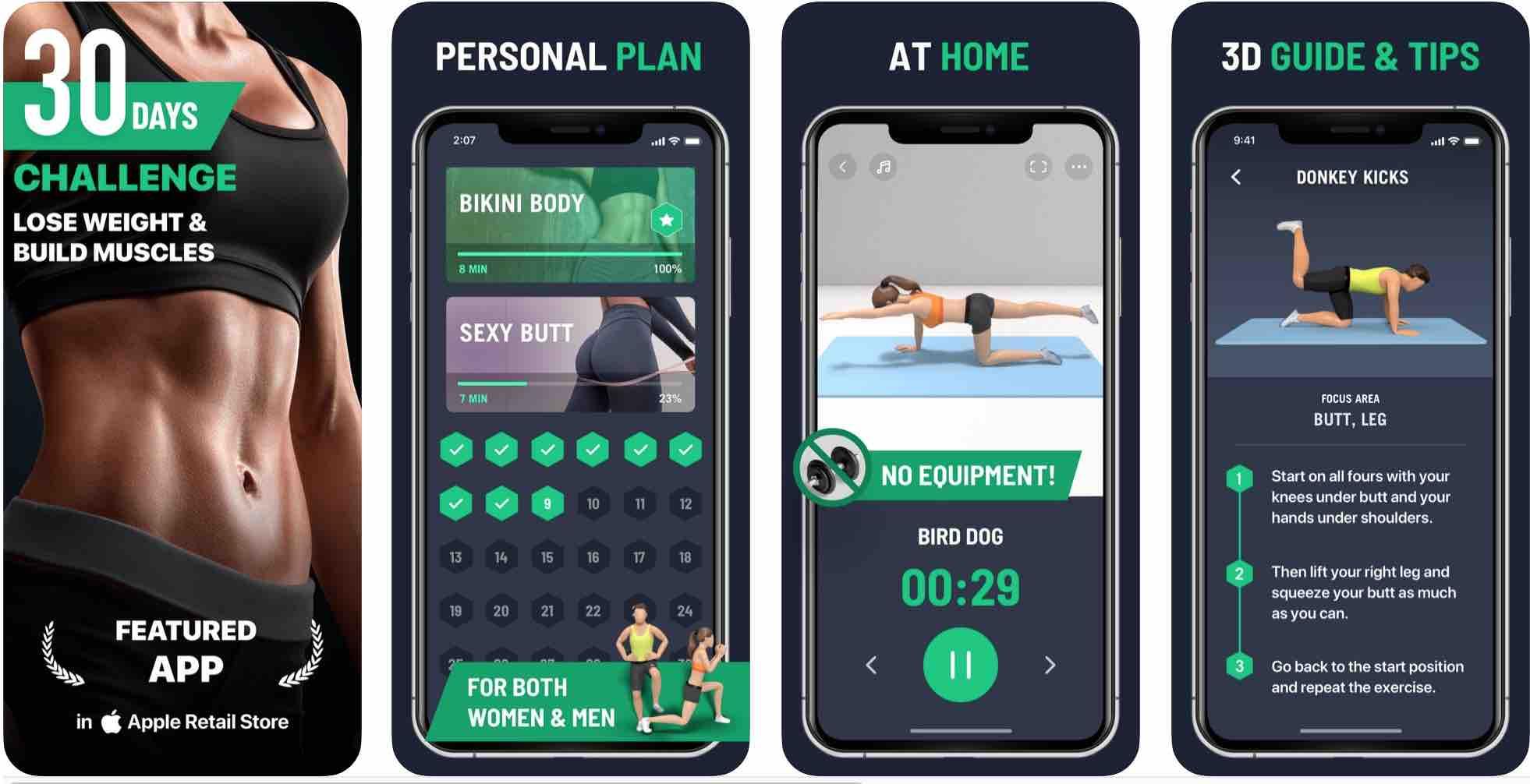

Online Fitness App

Home Workouts provides daily workout routines for all your main muscle groups. In just a few minutes a day, you can build muscles and keep fitness at home. #1 Digital Fitness. Train Anytime. Anywhere. Get your custom fitness plan tailored to your goals and lifestyle, and enjoy the most personalized workout. Best Workout App Overall: Caliber; Best Personal Training Workout App: Future; Best Strength Training Workout App: Boostcamp; Best Workout App for Yoga. If you're curious about how I help personal trainers, health & fitness coaches attract, convert and retain clients -- watch this. NO EQUIPMENT EXERCISES. WORKOUT AT HOME. HOME WORKOUT. NO EQUIPMENT · , Reviews ; WALKING & RUNNING. STEPS & RUNNING TRACKER. STEP COUNTER. Pedometer Free &. Here is the list of best free workout apps: · 1. FitOn Workouts & Fitness Plans · 2. Nike Training Club: Fitness · 3. Workout for Women | Weight. Reach your health, fitness & weight goals with MyFitnessPal, the #1 nutrition tracking app. Macro & calorie calculator, food tracker, and fasting app in one. Some popular workout apps that offer automated features and customizable workout plans include Nike Training Club, Fitbod, MyFitnessPal, JEFIT. In making our list of the best workout apps, Caliber topped our list for its expansive features for group training and one-on-one training. Home Workouts provides daily workout routines for all your main muscle groups. In just a few minutes a day, you can build muscles and keep fitness at home. #1 Digital Fitness. Train Anytime. Anywhere. Get your custom fitness plan tailored to your goals and lifestyle, and enjoy the most personalized workout. Best Workout App Overall: Caliber; Best Personal Training Workout App: Future; Best Strength Training Workout App: Boostcamp; Best Workout App for Yoga. If you're curious about how I help personal trainers, health & fitness coaches attract, convert and retain clients -- watch this. NO EQUIPMENT EXERCISES. WORKOUT AT HOME. HOME WORKOUT. NO EQUIPMENT · , Reviews ; WALKING & RUNNING. STEPS & RUNNING TRACKER. STEP COUNTER. Pedometer Free &. Here is the list of best free workout apps: · 1. FitOn Workouts & Fitness Plans · 2. Nike Training Club: Fitness · 3. Workout for Women | Weight. Reach your health, fitness & weight goals with MyFitnessPal, the #1 nutrition tracking app. Macro & calorie calculator, food tracker, and fasting app in one. Some popular workout apps that offer automated features and customizable workout plans include Nike Training Club, Fitbod, MyFitnessPal, JEFIT. In making our list of the best workout apps, Caliber topped our list for its expansive features for group training and one-on-one training.

fitness app for you Just invite your friend via the PF App and they'll be able to register online. There are good free programs online, I know this, but I've never been so consistent with something as I am with this app. My coach is great and. The ultimate Personal Training Software. Save time, boost earnings and deliver better client results with the best app for personal trainers. TrainingPeaks provides a platform for coaching and planned workouts designed to help you achieve your fitness goals. Centered around data and structured. Our gym planner fitness app offers full body workout plans with many free 3D exercises, to help you achieve your body goals. Great app for home workouts! I signed up with Team Maximus. The app works great. Coaches set up the daily routine, client hits go! Ofers a great way to. A personal trainer in your pocket. Have fun working out at home or the gym with the best training programs, video classes, and fun motivation from a hardworking. The #1 coaching app to better engage your clients. Take your coaching online and deliver an experience like nothing your clients have ever seen before. vov-chr.ru - best fitness app builder; AppMachine - best fitness app builder for beginners; BuildFire - best fitness app builder for integrations; vov-chr.ru -. Strength in Numbers ; App Store · star average. K Worldwide Reviews ; Google Play Store · star average. 27K Worldwide Reviews ; Strong Worldwide. 3M+. Whether you want to mix up your workouts or just prevent boredom, the Daily Workouts Fitness Trainer app features over 90 exercises for you to choose from. Achieve your fitness goals through customised coaching and actionable tips based on your health and activity history. Create your own custom fitness video app. Turn your video workouts into your fitness channel with Vimeo OTT, no sweat. Start a video subscription platform. Easily track your Workouts, set Training Plans, and discover new Workout Routines to crush your goals. Get Started. Set goals, Log Workouts, Stay on Track. Best-known for its at-home indoor cycling classes, Peloton is among the most popular home fitness apps right now. And for those who like to keep a close eye on. Work out anywhere · Strength, yoga, outdoor running, & gym workouts · $/mo · Exercise bike, treadmill, & rower workouts · $24/mo · Thousands of classes to keep. Use these reviews of the best workout apps, classes, and memberships to reach your fitness goals and motivate yourself to exercise. A personal trainer in your pocket. Have fun working out at home or the gym with the best training programs, video classes, and fun motivation from a hardworking. If you're curious about how I help personal trainers, health & fitness coaches attract, convert and retain clients -- watch this. Fiit | The #1 Rated Fitness App - Get started for free and discover hundreds of killer on-demand workouts with world-class trainers.

Does Buying A Car Increase Your Credit Score

Your new car loan can benefit your payment history and credit mix, two of the factors that go into your credit score. Paying your bills in full and on time is. Your credit score is complex and applying for an auto loan when trading in your car is unlikely to impact you much in most cases. However, our financial. After buying a car, you can expect to see your score improve after making monthly payments on time and paying down your loan balance. Does paying off a car loan. Most credit scores can get you a car loan, but your credit score will have a direct impact on the interest rate. Despite all the benefits of modern car shopping, one thing to be careful about when buying a new car is applying for an auto loan. While it's good to shop. The higher your score, the lower the risk you pose, the more you can borrow, and the lower the interest rate a lender will charge you on a car loan. In other. For people with only one or two accounts the drop will be larger. The good news is that as you make on-time car loan payments your credit score will increase. If you don't have the cash on hand to buy a car up front, you're not alone. Most folks turn to financing their car purchase with an auto loan. Buying a new car will actually ding your credit temporarily, but it will help in the long run because it shows variety in types of debt you can. Your new car loan can benefit your payment history and credit mix, two of the factors that go into your credit score. Paying your bills in full and on time is. Your credit score is complex and applying for an auto loan when trading in your car is unlikely to impact you much in most cases. However, our financial. After buying a car, you can expect to see your score improve after making monthly payments on time and paying down your loan balance. Does paying off a car loan. Most credit scores can get you a car loan, but your credit score will have a direct impact on the interest rate. Despite all the benefits of modern car shopping, one thing to be careful about when buying a new car is applying for an auto loan. While it's good to shop. The higher your score, the lower the risk you pose, the more you can borrow, and the lower the interest rate a lender will charge you on a car loan. In other. For people with only one or two accounts the drop will be larger. The good news is that as you make on-time car loan payments your credit score will increase. If you don't have the cash on hand to buy a car up front, you're not alone. Most folks turn to financing their car purchase with an auto loan. Buying a new car will actually ding your credit temporarily, but it will help in the long run because it shows variety in types of debt you can.

You can get a car loan and buy a vehicle with nearly any credit score, but your chances of being rejected – or charged a punitive level of interest – are much. Having a good credit score prior to purchasing your car can dramatically improve your chances of getting approvals and may even save you money. If your credit. Most people know that their credit score affects whether they are approved for a loan and influences the interest rate at which that loan is charged. Auto loans. The truth is, car loans in good standing can boost your credit score over time. But when you first make the purchase, since there is no payment history. Fortunately, if you can get approved for a car loan and keep up with the payments, your investment will improve your credit score. Once you are financially. Another consideration is that lenders like to look at the total amount of your monthly bills. If your new auto loan payment is less than your old loan payment. Getting a car loan can help you build up your credit by growing both your payment history and your credit mix. Out of all the different factors that work. If you are considering buying or leasing a new vehicle, you may be paying close attention to your credit score. This number determines what your car loan. Credit-Score-Icon how does my auto loan affect my credit score? Long term, taking out an auto loan can positively impact your credit score. When you first. If you pay your car finance loan on time and in full each month, over time, this can improve your credit score. Payment history is one of the biggest factors of. By making consistent on-time loan payments, you can boost your credit score and increase your eligibility for attractive interest rates down the road. Your credit score will have an impact on your loan & lease approval and will also determine the interest rate on your auto loan. So what is a FICO credit score. If you are considering buying or leasing a new vehicle, you may be paying close attention to your credit score. This number determines what your car loan. You are still the one making the car payments, which means you will be the one building credit. Does Co-Signing for Someone Affect Your Credit Score? Yes, it. Lenders use this score to determine the interest rate, terms and approval of auto loan applications. A higher FICO Auto Score tells the lender you're a lower. Lenders use this score to determine the interest rate, terms and approval of auto loan applications. A higher FICO Auto Score tells the lender you're a lower. Having a good credit score can really expand your opportunities when it comes to purchasing a vehicle. The two biggest components of your credit score are your. Whether you're buying your first car or need to replace the car you have now, you'll probably need to get a car loan. Listen, cars are expensive and most. Your credit score will have an impact on your loan & lease approval and will also determine the interest rate on your auto loan. So what is a FICO credit score. In general, paying off an installment loan such as a car loan has no effect on your credit score at all. There has been some disagreement on.

Can I Buy Crypto On Td Ameritrade

Clients looking for spot bitcoin ETFs or spot ether ETFs can find these and other third-party ETF and mutual fund products available at Schwab. These funds. While TD customers cannot purchase Bitcoin outright, they can buy Bitcoin futures contracts through the brokerage. Here's the thing: you can't directly buy cryptocurrencies like Bitcoin or Ethereum on TD Ameritrade's platform. While they do offer access to. One asset that TD Ameritrade doesn't currently support is cryptocurrency. Clients can buy shares of crypto-themed ETFs, but there's no way to invest. Cryptocurrency investors can buy or sell them directly in a spot market, or they can invest indirectly in a futures market or by using investment products. TD Ameritrade was a stockbroker that offered an electronic trading platform for the trade of financial assets. The company was founded in as First. You can buy and sell Canadian or U.S.-based Crypto ETFs with any TD Direct Investing account. If you don't have an account, click here to open. Learn more here. The company plans to offer cryptocurrency investing as well. Traders will appreciate the Thinkorswim trading platform. Do-it-yourselfers will benefit from the. You can buy and sell Crypto ETFs with a TD Direct Investing account, find out more here. What are Crypto ETFs? Crypto ETFs are investment funds that track the. Clients looking for spot bitcoin ETFs or spot ether ETFs can find these and other third-party ETF and mutual fund products available at Schwab. These funds. While TD customers cannot purchase Bitcoin outright, they can buy Bitcoin futures contracts through the brokerage. Here's the thing: you can't directly buy cryptocurrencies like Bitcoin or Ethereum on TD Ameritrade's platform. While they do offer access to. One asset that TD Ameritrade doesn't currently support is cryptocurrency. Clients can buy shares of crypto-themed ETFs, but there's no way to invest. Cryptocurrency investors can buy or sell them directly in a spot market, or they can invest indirectly in a futures market or by using investment products. TD Ameritrade was a stockbroker that offered an electronic trading platform for the trade of financial assets. The company was founded in as First. You can buy and sell Canadian or U.S.-based Crypto ETFs with any TD Direct Investing account. If you don't have an account, click here to open. Learn more here. The company plans to offer cryptocurrency investing as well. Traders will appreciate the Thinkorswim trading platform. Do-it-yourselfers will benefit from the. You can buy and sell Crypto ETFs with a TD Direct Investing account, find out more here. What are Crypto ETFs? Crypto ETFs are investment funds that track the.

How to buy crypto TD Ameritrade?In short, to buy crypto TD Ameritrade, investors in the US will need to sign up with a FINRA-regulated crypto exchange like. TD Ameritrade is a popular brokerage platform that allows users to trade various financial instruments, including stocks, options, and futures. While TD. Here's the thing: you can't directly buy cryptocurrencies like Bitcoin or Ethereum on TD Ameritrade's platform. While they do offer access to. While TD Ameritrade doesn't offer direct cryptocurrency trading like dedicated crypto exchanges, it provides access to Bitcoin and Ethereum. Cryptocurrency investors can buy or sell them directly in a spot market, or they can invest indirectly in a futures market or by using investment products. You can buy and sell Canadian or U.S.-based Crypto ETFs with any TD Direct Investing account. If you don't have an account, click here to open. Learn more here. Shareholders can sell their TD Ameritrade stock through EquityZen's private company marketplace. EquityZen's network includes over K accredited investors. TD Ameritrade, Inc. has been acquired by Charles Schwab, and all accounts have been moved. At Schwab, you get access to thinkorswim® trading platforms and. TD Ameritrade does not offer contracts for difference (CFDs). You buy and trade the actual assets. TD Ameritrade only provides access to the US financial. These ETFs can be bought and sold for FREE within TD Ameritrade accounts. Compare their year-to-date performance, price, total assets and ratings. Our retail clients are seeking to access and trade digital currency products in the same way they do with traditional capital markets – through a legitimate. At this point in time, we do not offer cryptocurrency trading, but qualified clients can currently trade bitcoin futures and micro bitcoin futures at TD. YOU CAN COUNT ON US. BECAUSE TRADERS TRUST US. · Tastytrade · Schwab · TD Ameritrade · E*Trade · Fidelity. Trade any amount Buy US stocks and ETFs for as little as $1 with fractional shares. Get an edge. Our intelligent tools and technology can help you make. With our reliable TD Ameritrade VPN solution, you can stay anonymous and protected while trading crypto. bit encryption ensures that no third parties. In a definite first, TD Ameritrade and Havas have placed an ad in the blockchain as a celebration of innovation and creativity. You can trade cryptocurrency futures at brokerages approved for futures and options trading. What Are Cryptocurrency Futures? Futures contracts of any. There are multiple ways of gaining indirect exposure to crypto on TD Ameritrade and they each have nuances to them, so kindly DYOR. You may not be able to trade all assets with TD Ameritrade. For example, if you live in the EU, you can't trade US ETFs. Check with your local regulators to. If your account is futures approved, you can request access to trade Bitcoin futures and Micro Bitcoin futures through the CME exchange.

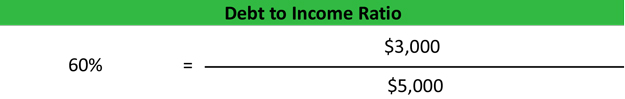

Debt To Income Ratio For A House

"A strong debt-to-income ratio would be less than 28% of your monthly income on housing and no more than an additional 8% on other debts," Henderson says. Why Your DTI Is So Important · Front end ratio is a DTI calculation that includes all housing costs (mortgage or rent, private mortgage insurance, HOA fees, etc.). How is the debt-to-income ratio calculated? To calculate your DTI, add up all of your monthly debt payments, then divide by your monthly income. Your debt-to-income ratio consists of two separate percentages: a front ratio (housing debt only) and a back ratio (all debts combined). A ratio? That sounds complicated, but it's just a numerical way to draw a comparison. Here, we're comparing overall housing and debt payments to pre-tax income. Debt Ratios For Residential Lending. Lenders use a ratio called "debt to income" to determine the most you can pay monthly after your other monthly debts are. Debt-to-income ratio for mortgage FAQs Most lenders would prefer their applicants to have a debt-to-income ratio of 43% or less, ideally at 36% or less. To calculate your DTI for a mortgage, add up your minimum monthly debt payments then divide the total by your gross monthly income. For example: If you have a. Debt-to-income ratio (DTI) is the ratio of total debt payments divided by gross income (before tax) expressed as a percentage, usually on either a monthly or. "A strong debt-to-income ratio would be less than 28% of your monthly income on housing and no more than an additional 8% on other debts," Henderson says. Why Your DTI Is So Important · Front end ratio is a DTI calculation that includes all housing costs (mortgage or rent, private mortgage insurance, HOA fees, etc.). How is the debt-to-income ratio calculated? To calculate your DTI, add up all of your monthly debt payments, then divide by your monthly income. Your debt-to-income ratio consists of two separate percentages: a front ratio (housing debt only) and a back ratio (all debts combined). A ratio? That sounds complicated, but it's just a numerical way to draw a comparison. Here, we're comparing overall housing and debt payments to pre-tax income. Debt Ratios For Residential Lending. Lenders use a ratio called "debt to income" to determine the most you can pay monthly after your other monthly debts are. Debt-to-income ratio for mortgage FAQs Most lenders would prefer their applicants to have a debt-to-income ratio of 43% or less, ideally at 36% or less. To calculate your DTI for a mortgage, add up your minimum monthly debt payments then divide the total by your gross monthly income. For example: If you have a. Debt-to-income ratio (DTI) is the ratio of total debt payments divided by gross income (before tax) expressed as a percentage, usually on either a monthly or.

Lenders vary in the specific DTI ratios they are looking for, but in general, lenders want to see a maximum front-end ratio somewhere between 28% and 31% and a. A lender will want your total debt-to-income ratio to be 43% or less, so it's important to ensure you meet this criterion in order to qualify for a mortgage. What Is a Good Debt-to-Income Ratio? Generally, 43% is the highest DTI ratio that a borrower can have and still get approved for a qualified mortgage, which. Typical co-op buyer financial requirements in NYC include 20% down, a debt-to-income ratio between 25% to 35% and 1 to 2 years of post-closing liquidity. Debt-. According to a breakdown from The Mortgage Reports, a good debt-to-income ratio is 43% or less. Many lenders may even want to see a DTI that's closer to 35%. A good debt-to-income ratio is usually 36% or lower, with no more than 28% of that debt dedicated toward servicing the mortgage on your home. A debt-to-income. Figuring out your DTI is simple math: your total monthly debt payments divided by your gross monthly income (your wages before taxes and other deductions are. Maximum DTI Ratios For manually underwritten loans, Fannie Mae's maximum total DTI ratio is 36% of the borrower's stable monthly income. The maximum can be. Your DTI is also used for what's known in mortgage lending circles as the 36/28 qualifying ratio. Although you can get approved for a home outside this metric. In most cases, 43% is the highest DTI ratio a borrower can have and still get a qualified mortgage. Above that, the lender will likely deny the loan application. Your particular ratio in addition to your overall monthly income and debt, and credit rating are weighed when you apply for a new credit account. Standards and. The answer to this question will vary by lender, but generally, a debt-to-income ratio lower than 35% is viewed as favorable meaning you'll have the flexibility. A general rule of thumb is to keep your overall debt-to-income ratio at or below 43%. This is seen as a wise target because it's the maximum debt-to-income. AgSouth Mortgages Home Loan Originator Brandt Stone says, “Typically, conventional home loan programs prefer a debt to income ratio of 45% or less but it's not. It is the percentage of your monthly pre-tax income you must spend on your monthly debt payments plus the projected payment on the new home loan. Most lenders go by the 28/36 rule - mortgage payment no more than 28% of gross income and total debt obligations no more than 36%. You can. An ideal DTI ratio is less than 36%, yet some lenders may approve a loan if DTI is up to 43%. Having a high credit score can help because it shows you are able. DTI is a component of the mortgage approval process that measures a borrower's Gross Monthly Income compared to their credit payments and other monthly. Lenders vary in the specific DTI ratios they are looking for, but in general, lenders want to see a maximum front-end ratio somewhere between 28% and 31% and a. Maximum DTI Ratios For manually underwritten loans, Fannie Mae's maximum total DTI ratio is 36% of the borrower's stable monthly income. The maximum can be.

Us Bank Business Loan Reviews

US Bank business loan offers small business loans with a maximum term of 80 months. Having the option of longer terms allows borrowers to take on larger loan. Personal loan: As of February 12, the fixed Annual Percentage Rate (APR) ranged from % APR to % APR, and varies based on credit score, loan amount. U.S. Bank lending options provide customizable funding and an easy online application process. Get a recommendation. Explore competitive loan rates and terms. Reviewers complaining about U.S. Bank most frequently mention customer service, credit card, and business account problems. U.S. Bank ranks rd among Banking. How U.S. Bank compares to other lenders · Loan amount. $5,$5 million · Interest rate. % · Term lengths. years · Min. time in business. 6 months. As part of our commitment to the growth of small businesses nationwide, U.S. Bank is proud to be an SBA Preferred Lender specializing in providing Small. Join the people who've already reviewed U.S. Bank. Your experience can help others make better choices. It's a good option for people who want a wide range of financial services, including checking and savings accounts, CDs, loans and credit cards. The bank offers. They gave me the lowest max loan amount out of any other bank for commercial SBA loans. I'm guessing the margins/paperwork involved aren't. US Bank business loan offers small business loans with a maximum term of 80 months. Having the option of longer terms allows borrowers to take on larger loan. Personal loan: As of February 12, the fixed Annual Percentage Rate (APR) ranged from % APR to % APR, and varies based on credit score, loan amount. U.S. Bank lending options provide customizable funding and an easy online application process. Get a recommendation. Explore competitive loan rates and terms. Reviewers complaining about U.S. Bank most frequently mention customer service, credit card, and business account problems. U.S. Bank ranks rd among Banking. How U.S. Bank compares to other lenders · Loan amount. $5,$5 million · Interest rate. % · Term lengths. years · Min. time in business. 6 months. As part of our commitment to the growth of small businesses nationwide, U.S. Bank is proud to be an SBA Preferred Lender specializing in providing Small. Join the people who've already reviewed U.S. Bank. Your experience can help others make better choices. It's a good option for people who want a wide range of financial services, including checking and savings accounts, CDs, loans and credit cards. The bank offers. They gave me the lowest max loan amount out of any other bank for commercial SBA loans. I'm guessing the margins/paperwork involved aren't.

Worst bank ever. I paid off my auto loan over a month ago. I called in more than 5 times to see when they would send my title. No one couldn. U.S. Bank Equipment Finance understands the needs you have to keep your business running smoothly. We'll work one-on-one with you to find a credit option that. US Bank customer service reviews US Bank receives fewer than one complaint for every 1, mortgage loans it underwrites, according to data from the Consumer. U.S. Bank offers a quick, online application process for loans and lines of credit of $, or less. But it isn't overly transparent about its rates and fees. U.S. Bank business loan options can be used to cover operating expenses, maintain inventory, pay vendors and more. Backed by the strength and stability of. U.S. Bank lending options provide customizable funding and an easy online application process. Get a recommendation. Explore competitive loan rates and terms. BBB accredited since 4/1/ Bank in Minneapolis, MN. See BBB rating, reviews, complaints, & more. On TrustPilot, U.S. Bank has a score of out of five based on over reviews.8 However, many reviews were focused on U.S. Bank's other products and. We've researched more than banks and credit unions, and we give U.S. Bank 4 out of 5 stars overall. It earns higher scores for its banking accessibility —. Personal Loan Reviews. LightStream Review · Best Egg Review · Avant Review. Learn business deposits and outstanding business credit balances. This offer. Find the best business line of credit options available from U.S Bank, and explore which solution offers the benefits that can help your business cash flow. For credit qualified applicants, the advertised interest rate for U.S. Bank Cash Flow Manager will be between Prime + % and Prime + %. The interest rate. Worst Loan Experience Ever! US Bank was absolutely HORRIBLE to work with and I will never use them again. This was only refinancing a small home equity loan. Terrible customer service. Everything is a lengthy process, they have 0 online tools to help service your loan. You have to call customer service for. • U.S. Bank Home Mortgage reviews, purchases, securitizes, and services business days of receipt of a RESPA application. ✓Lenders can go to CFPB. Yes, there are different types of Small Business Administration loans, but all require a core set of documents. Here's how you can apply to get a loan via. Ratings and Reviews · Love the USBank Mobile App · Such An Amazing Interface! · #1 Bank in the United States. Get quick access to capital with flexible lending solutions from US Bank®. With these financing options, you can expand operations, build inventory, pay. Yes, there are different types of Small Business Administration loans, but all require a core set of documents. Here's how you can apply to get a loan via. U.S. Bank's Platinum Business Money Market Savings Rates. Daily Balance Business Loans; Mortgages; Mortgage Refinance · Home Equity Loans and Lines of.

Ach Bank Transfer Fee

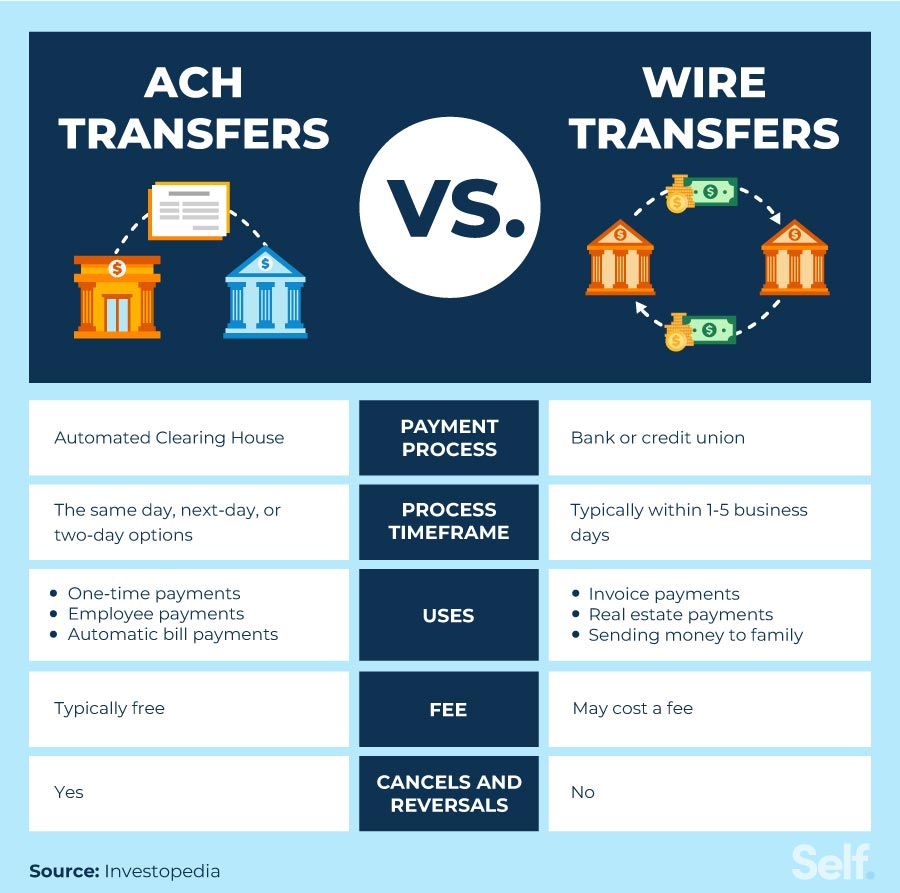

You can instantly send up to $10,* per transfer, 24 hours a day, 7 days a week, for a fee of % of the transfer amount. If you have a Square Checking. Fees are usually higher than ACH fees and can cost about $25 to send and $15 to receive. International wire transfers can cost upwards of $ These are only. Wire transfer fees range between $10 and $50 for outgoing international wire transfers and $0 to $25 for outgoing international wire transfers within the U.S. How much is an ACH transfer fee? Banks will often charge a fee for an external ACH—sending money to an account at a different bank. The cost of ACH transfers. Do ACH Payments Cost Consumers Money? Unlike wire transfers, which often require you to pay a fee per transaction, there's generally no fee to send or receive. For each Invoice2go Stripe ACH Bank Transfer, a fee will be deducted from the amount your customer pays you. Transaction fees differ. Yes, there's a $1 processing fee charged for each ACH payment transaction. See: How do I send a small business ACH payment? Contact us. Make an appointment. On average, one transaction can cost you up to $ However, the fees can be between $ and $ The inflated cost also covers transferring the ACH funds. Does an external transfer cost money? No, we don't charge a fee. Your other bank may charge a fee to move money to Chase, so you should check with them. You can instantly send up to $10,* per transfer, 24 hours a day, 7 days a week, for a fee of % of the transfer amount. If you have a Square Checking. Fees are usually higher than ACH fees and can cost about $25 to send and $15 to receive. International wire transfers can cost upwards of $ These are only. Wire transfer fees range between $10 and $50 for outgoing international wire transfers and $0 to $25 for outgoing international wire transfers within the U.S. How much is an ACH transfer fee? Banks will often charge a fee for an external ACH—sending money to an account at a different bank. The cost of ACH transfers. Do ACH Payments Cost Consumers Money? Unlike wire transfers, which often require you to pay a fee per transaction, there's generally no fee to send or receive. For each Invoice2go Stripe ACH Bank Transfer, a fee will be deducted from the amount your customer pays you. Transaction fees differ. Yes, there's a $1 processing fee charged for each ACH payment transaction. See: How do I send a small business ACH payment? Contact us. Make an appointment. On average, one transaction can cost you up to $ However, the fees can be between $ and $ The inflated cost also covers transferring the ACH funds. Does an external transfer cost money? No, we don't charge a fee. Your other bank may charge a fee to move money to Chase, so you should check with them.

Some businesses however, may have to pay a separate fee from $5 to $30 per month to use ACH for transferring money. There are also additional potential charges. There are no fees to receive ACH payments (also known as direct deposit or electronic money transfers). · There's a fixed fee of USD to receive USD via. ACH payments (bank transfers) are only fee-free for the clients who are paying for the inspection. They are still run through a payment processor, so there is. Pay no fees when you submit your ACH transfer through Digital Banking. Clock. Reliable time frame. The money you send will reach your recipient within three. However, most parties use processing partners who typically add a flat fee per transaction (anywhere from $ to $). While higher-value payments may also. Credit cards generally carry a fee around % of the value of the transaction, and they have a flat-rate processing fee. ACH transactions usually cost between. A wire transfer is handled by two individual banks who work directly to verify funds and complete the transaction. · bank charged a fee for the transaction—it's. Many of our competitors charge between $5–15 per failed transaction. Hidden fees can add up quickly. What is the transaction cap per ACH transaction? A debit fee typically ranges from $ to $ depending on your business model and the perceived risk of each individual transaction. Credit Fee – A credit. High Cost. Column 1. High Cost Home · Get Started · Funds · CAF Phase II Model · CAF There are two ways to send an ACH transfer from your bank after you've. The usual ACH transfer cost is $ and $, typically landing at $ This means that ACH payments are one of the more affordable options for businesses. ACH transfers are much more cost-efficient when compared to wire transfers, which can range between $25 to $75 for international outbound transfers. Wire. A wire transfer typically costs between $20 - $30 to send. The cost will vary from bank to bank, and your bank will be able to confirm the exact amount for. Processors can charge additional fees, but where they run between 1 and % (with a typical cap of $5), credit cards charge between % and % and wire. The median internal cost for processing ACH payments is $ per transaction. However, the total cost associated with accepting ACH payments varies depending. Alliant does not charge a fee for incoming ACH transfers, but the financial institution that you are transferring the funds from may charge a fee. You will, however, be responsible for any fees your financial institution may charge you for the actual transfer of funds. It is highly unlikely that your. If a service provider charges the sender, the charge will be around $1 per payment. Businesses that use ACH transfers to pay employee wages or collect bill. While ACH transfers also have processing fees, they tend to be a lot lower than card fees. ACH payments cost between $ and $ On the other hand, credit. A single monthly fee based on total FedGlobal ACH Payments origination volume. 27 This per-item surcharge is in addition to the standard domestic origination.